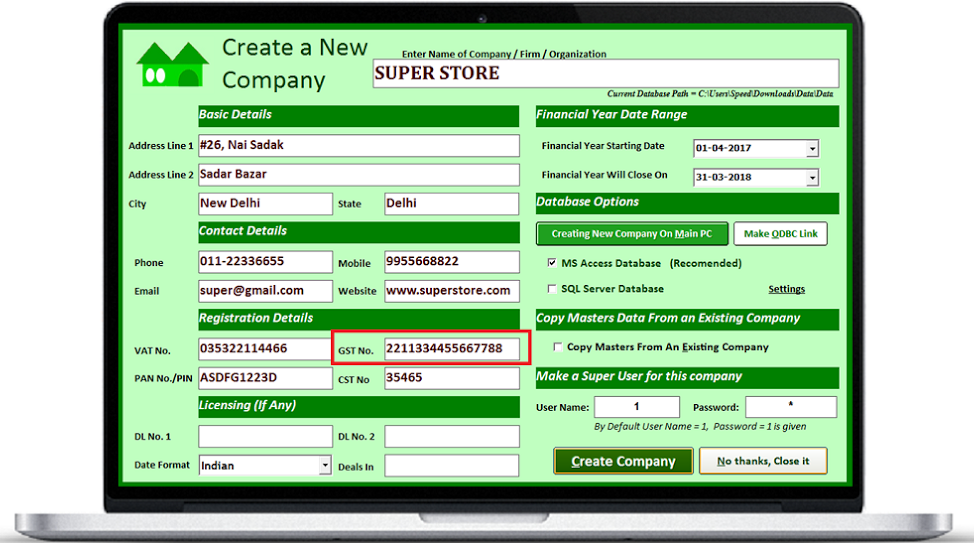

Enter GSTIN No. of company while creating a New company

What is GST Identification Number (GSTIN)?

All the business entities registering under GST will be provided a unique identification number known as GSTIN or GST Identification Number.

Currently any dealer registered under state VAT law has a unique TIN number assigned to him by state tax authorities. Similarly, service tax registration number is assigned to a service provider by Central Board of Excise and Customs (CBEC).

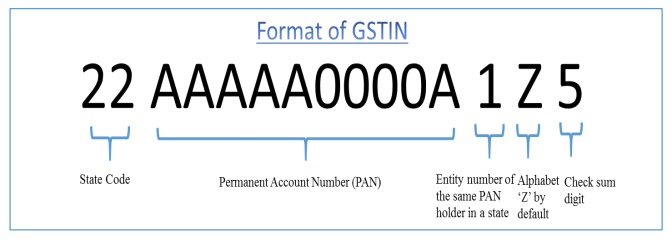

Let’s understand the structure of GST Identification Number:

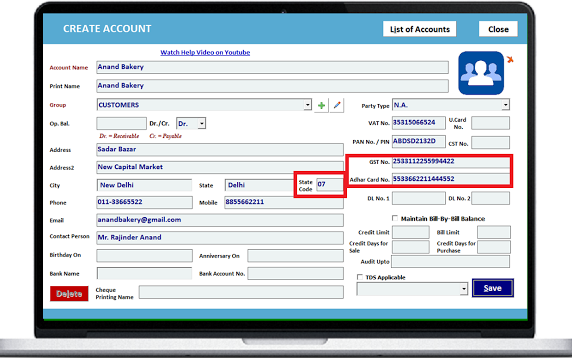

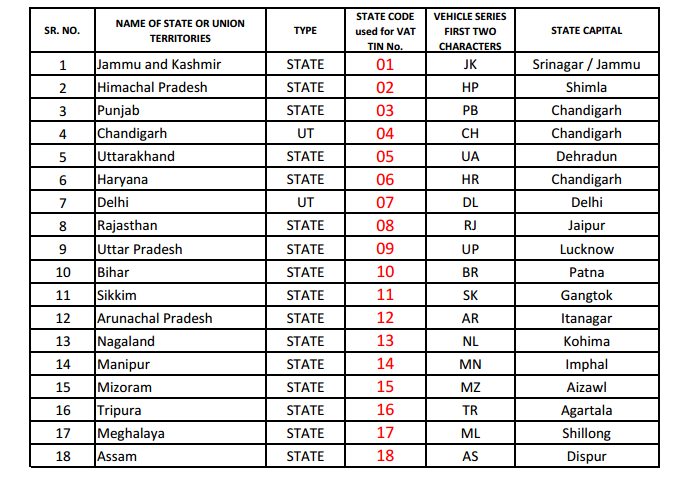

- Every taxpayer will be assigned a state-wise PAN-based Goods and Services Taxpayer Identification Number (GSTIN) which will be 15 digit long.

- The first two digits of GSTIN will represent the state code. Each state has a unique two digit code like “27” for Maharashtra and “10” for Bihar.

- The next ten digits of GSTIN will be the PAN number of the taxpayer.

- 13th digit indicates the number of registrations an entity has within a state for the same PAN.

It will be an alpha-numeric number (first 1-9 and then A-Z) and will be assigned on the basis of number of registrations a legal entity (having the same PAN) has within one state.

For example, if a legal entity has single or one registration only within a state then it will be assigned the number “1” as 13th digit of the GSTIN. If the same legal entity gets another or second registration for a second business vertical within the same state, then the 13th digit of GSTIN assigned to this entity will become “2”. Similarly, if an entity has 11 registrations in the same state then it will be assigned letter “B” in the 13th place. This way up to 35 business verticals of any legal entity can be registered within a state using this system.

- The fourteenth digit currently has no use and therefore will be “Z” by default.

- The last digit will be a check code which will be used for detection of errors.

List of State Codes Under GST System

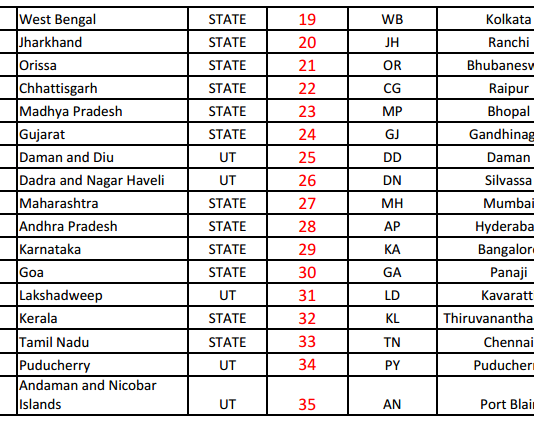

In Options change Taxation System from Vat to GST

Create New Tax Slabs For GST.

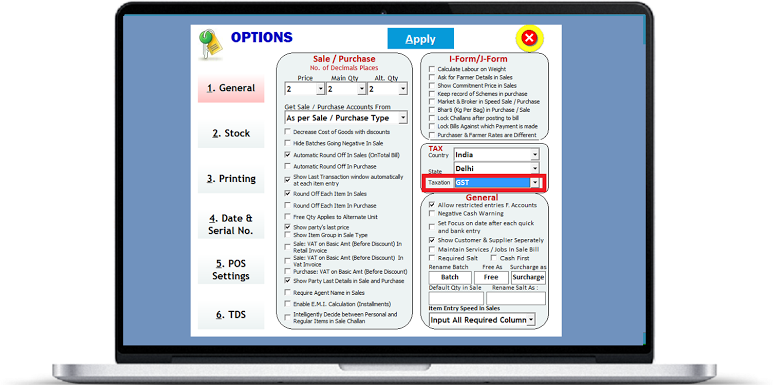

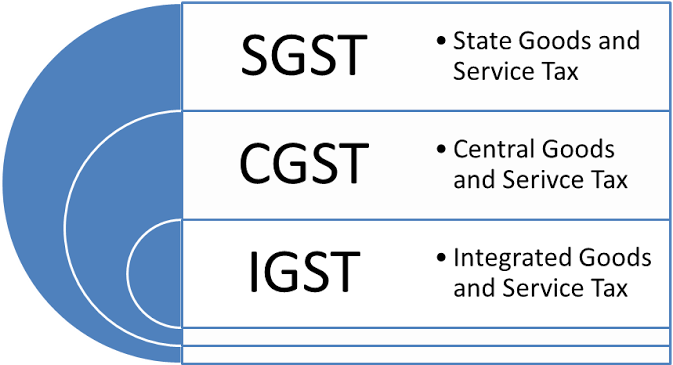

SGST and CGST will be charged on all bills made within state

IGST will be charged from out of state customers.

Although rate of tax is same in both cases,

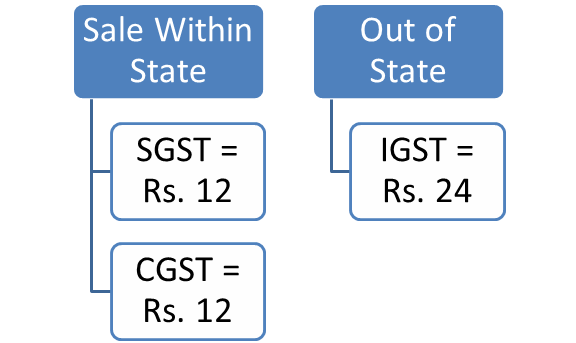

In case of Sale Within state, customer will be charged SGST & CGST in 50:50 Ratio

And in case of Interstate Sales, Total Tax will be charged as IGST.

This Example may help you understand GST Model more clearly

SGST and CGST will be charged on all bills made within state

IGST will be charged from out of state customers.

Although rate of tax is same in both cases,

Tax Rates Under GST System

Different – different Tax rates (percentages) are defined for various goods & services.

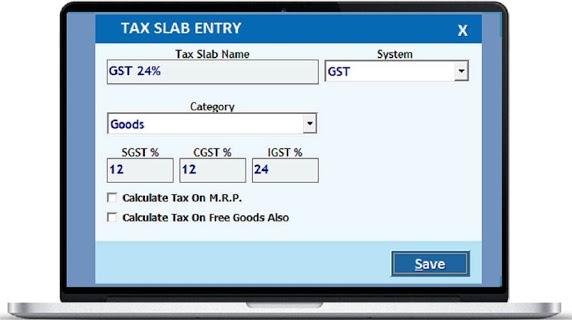

In Business ERP Software you need to create these tax slabs

Click masters --> Tax Slab

- Enter a Unique Tax Slab Name representing the Tax Percentage

- Choose System as GST.

- Choose Category (Goods or Services)

- Enter SGST, CGST and IGST Percentages.

(as we discussed above, in case of sales within state, SGST and CGST will be charged)

If you are selling out of state Only IGST Will be charged

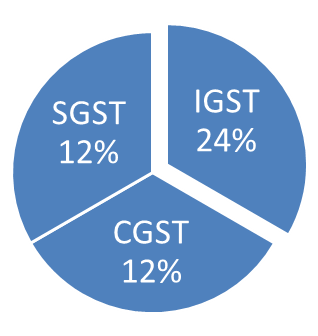

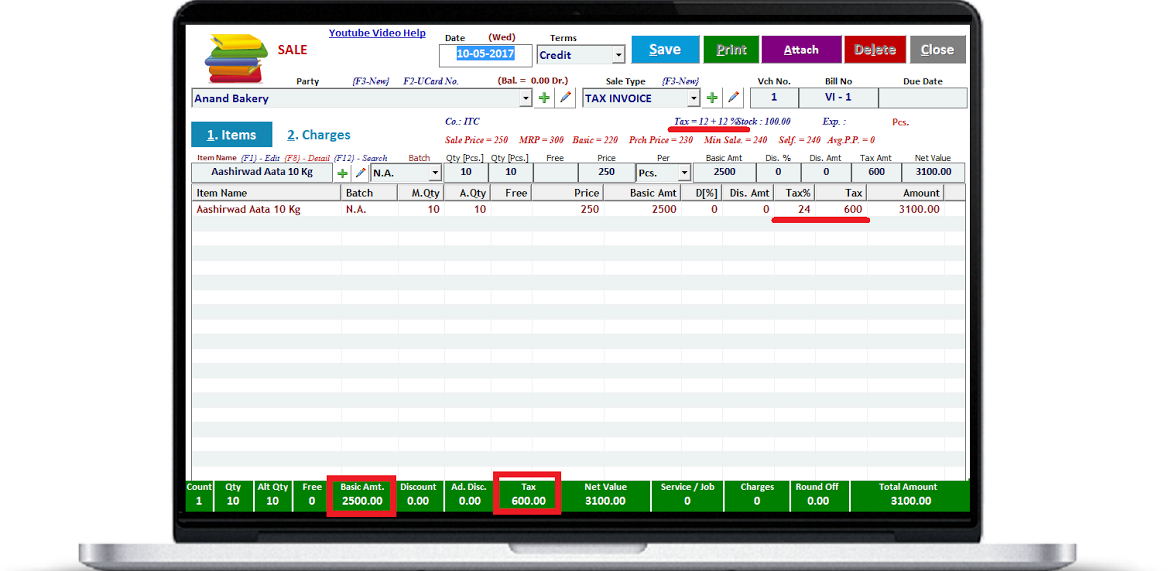

You need to define SGST and CGST in 50:50 Ratio. And IGST as full ratio.For Example you need to charge GST @ 24%, then create Tax Slab as follows

In Both cases, customers are charged Rs. 24 towards Tax

In Both cases, customers are charged Rs. 24 towards Tax

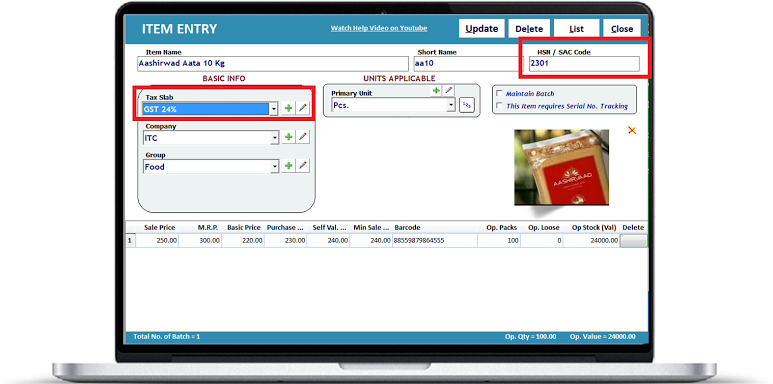

Changes in Item Master

- Define HSN / SAC Code of the item

- Define GST % of the item

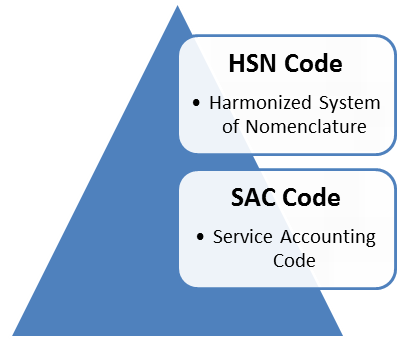

HSN code means Harmonized System Nomenclature code

The term HSN number is widely used for taxation purpose in many countries including India. The following links help you to find HSN code number for your commodity for GST documentation like preparation of GST Tax Invoice, computation of GST etc. However, you may reconfirm the correctness of such HSN code mentioned in this website with GST authorities in India.

It is a multipurpose international product nomenclature developed by the World Customs Organization (WCO). In simple words, it is an internationally accepted product coding system formulated for classification of goods. India being a member of WCO, HSN is being used in the country for Customs and Central Excise Classifications since 1985. Now, HSN Codes will also be used for GST enrolment/registration purposes. Please find below the list of HSN Codes of products for GST Enrolment purposes:

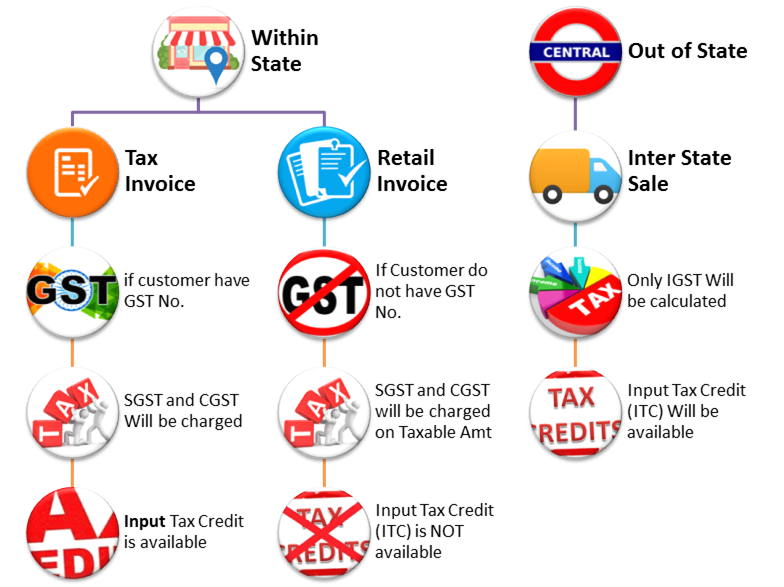

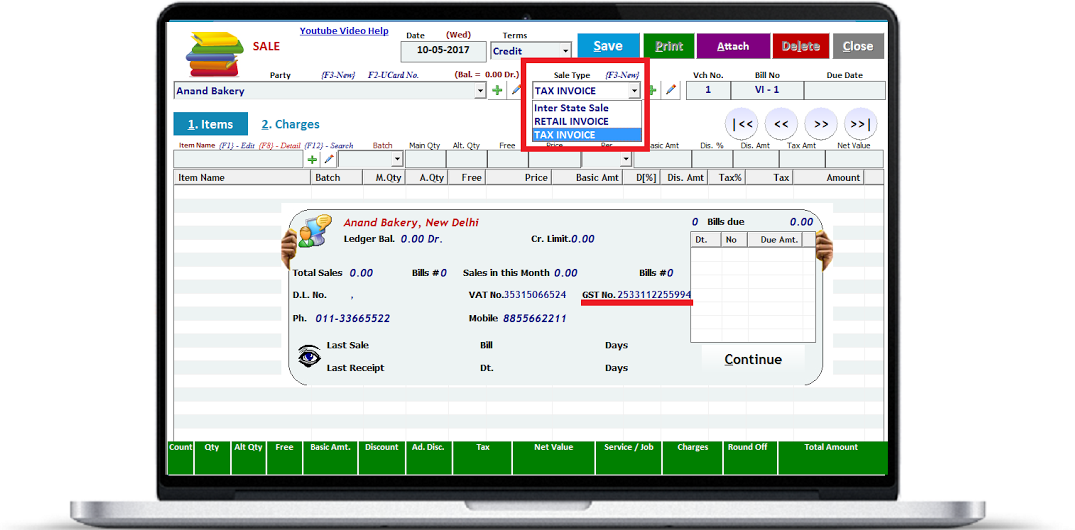

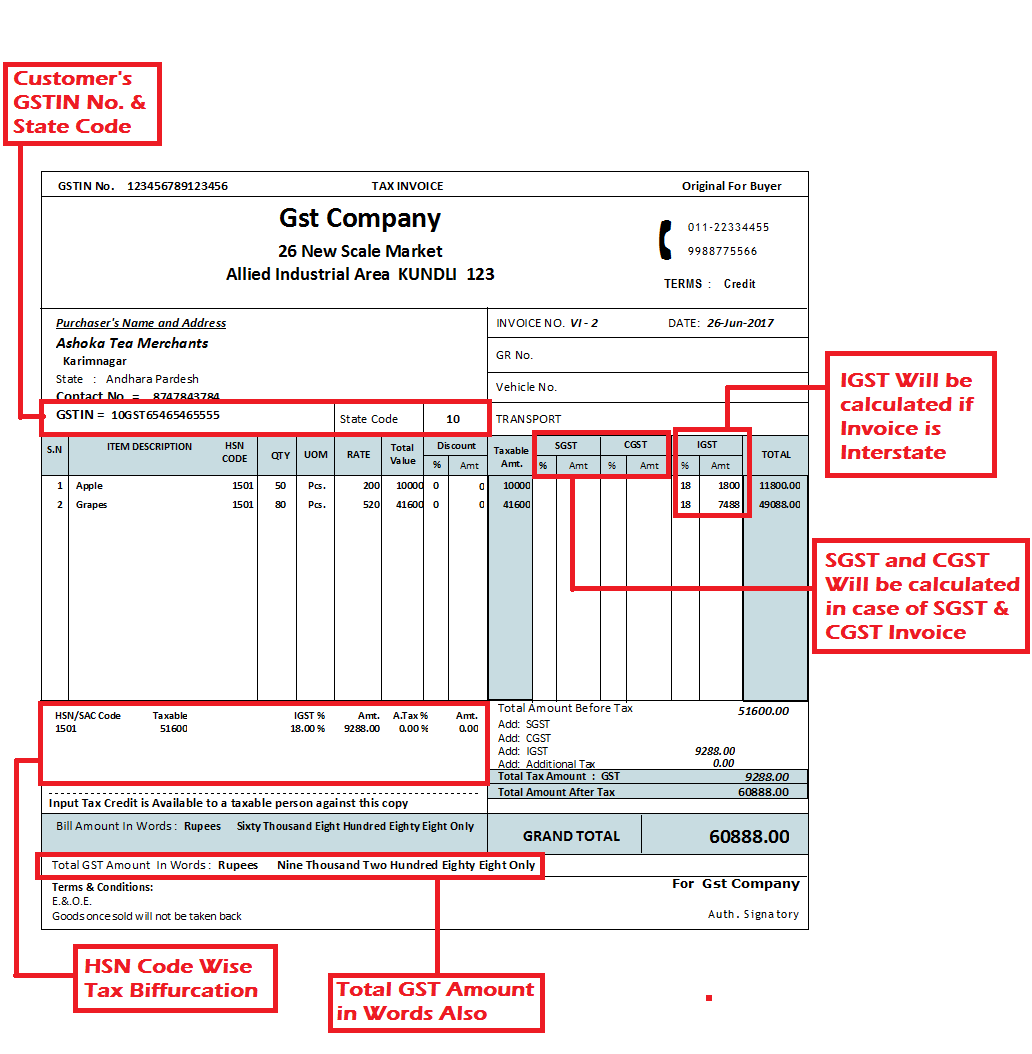

Understanding Difference between Tax Invoice, Retail Invoice and Interstate Invoice.

Choose Sale Type Properly

Basically there are 4 types of sales

Interstate B2B Sale: if customer belongs to some another state, then select this Sale Type. Only IGST Will be charged on taxable amount. Input Tax credit is available to taxable person against this invoice. Customer must be taxable person with GSTIN No.

Interstate Retail Sale: if customer is non taxable and belongs to some another state, then select this Sale Type. Only IGST Will be charged on taxable amount. Input Tax credit will not available to consumer against this invoice. Customer must be taxable person with GSTIN No.

Local Retail Sale: Choose this Invoice if your customer is within state and DO NOT HAVE GSTIN No. (Unregistered Person / end user / consumer). SGST and CGST will be calculated on taxable amount. Input Tax Credit (ITC) will not be available to a taxable person against this invoice.

Local B2b Sale: Choose this Invoice if your customer is within state and have GSTIN No. (registered GST Dealers). SGST and CGST will be calculated on taxable amount. Input Tax Credit (ITC) will be available to a taxable person against this invoice

GST Invoice

From Accountancy Point of View

Accounts of SGST and CGST will be credited with the amount of tax.

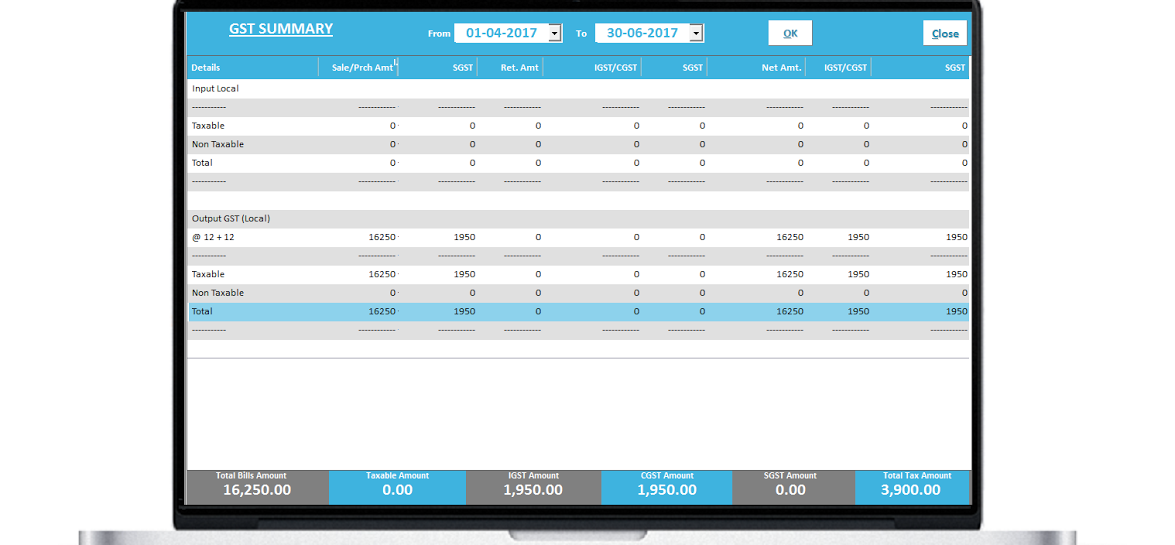

GST Reports

GST Summary

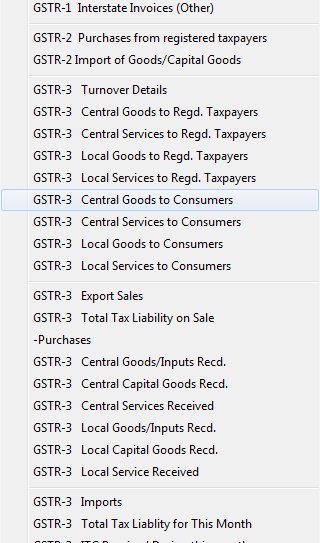

GSTR – 1

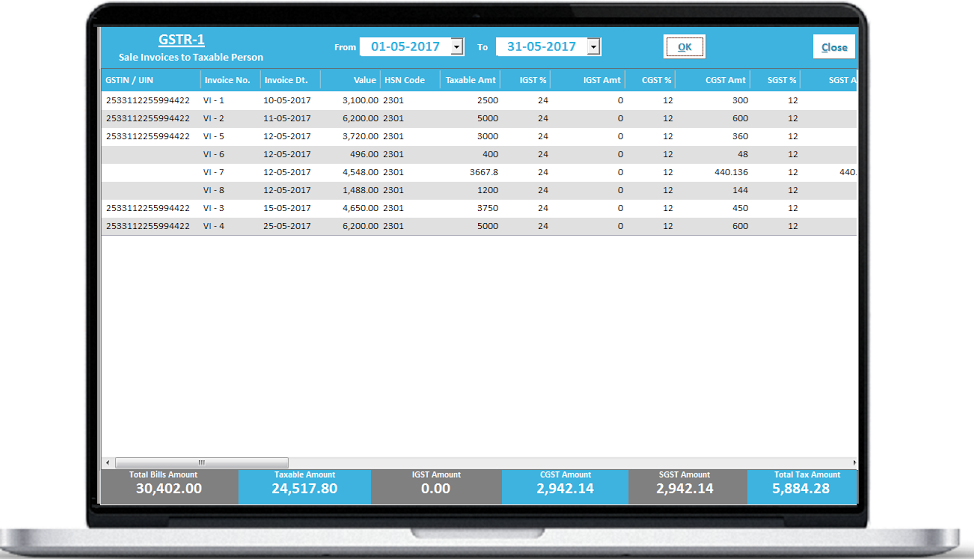

List of Sale Invoices to Taxable Person within state

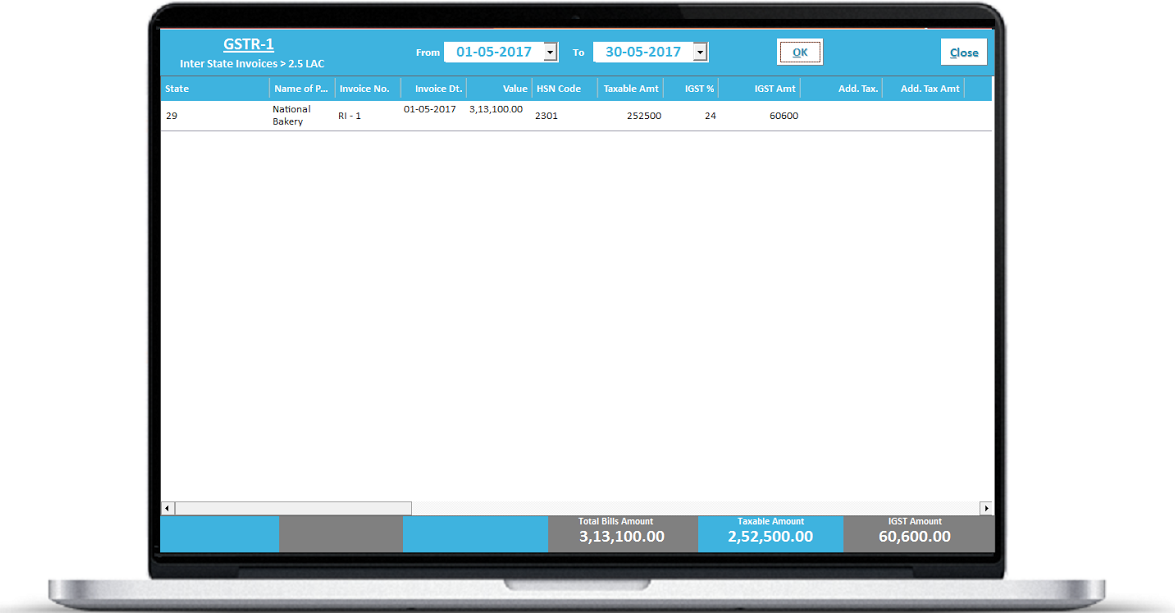

List of Interstate Invoices for more than 2.5 Lac Value

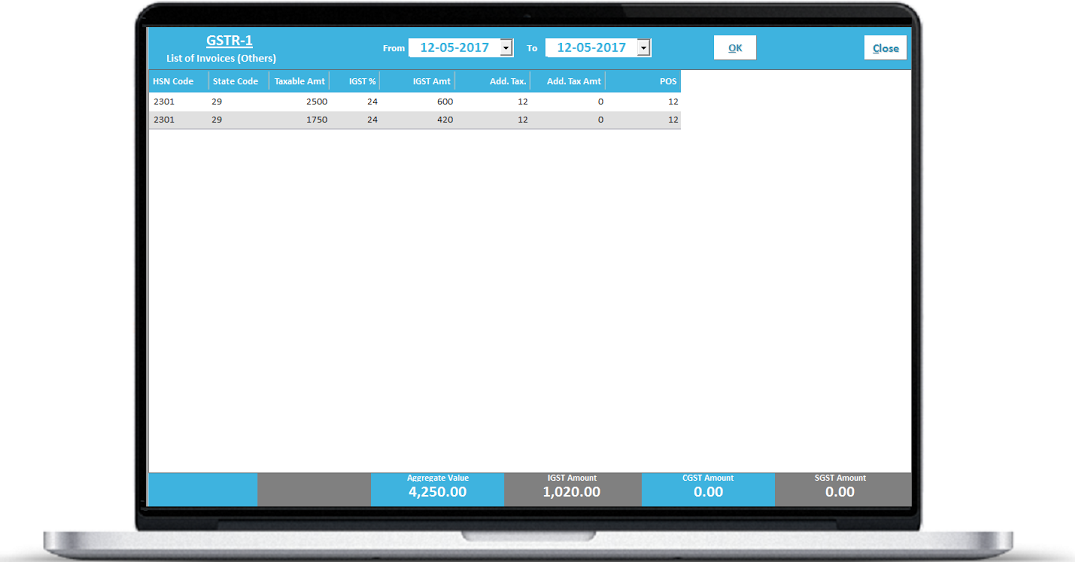

List of other Interstate Invoices

GSTR-3

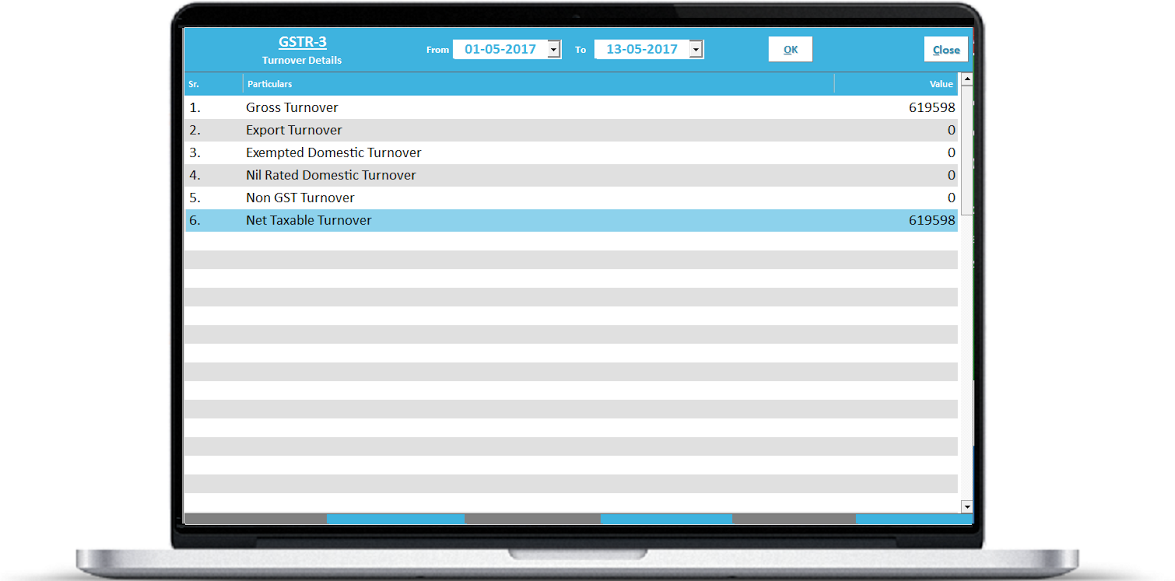

Turnover Details

Central Goods to Regd. Taxpayers

Shows state wise Sales of Goods and IGST Details with tax rate wise bifurcation

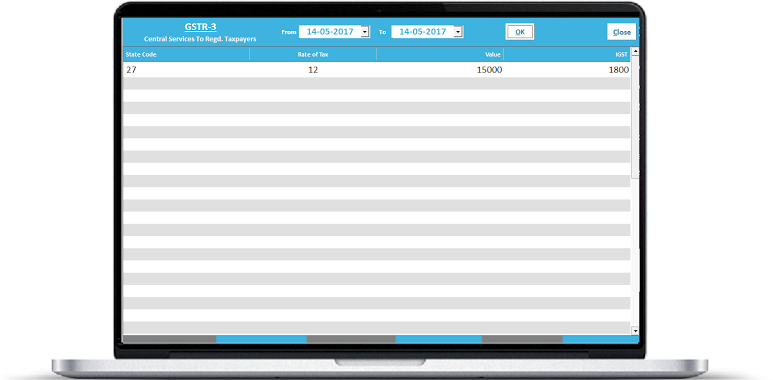

Central Services to Regd. Taxpayers

Shows state wise Sales of Services and IGST Details with tax rate wise bifurcation

Shows sales entries where

Tax Slab must be made as GST System and

category = services

Customer’s State code and GST No. is given

properly

Sale Type Region = Central

Local Goods to Regd. Taxpayers

Shows sales entries where

- Tax Slab must be made as GST System and category = Goods

- SGST and CGST Rates are specified

- Customer’s State code and GST No. is given properly

- Sale Type Region = Local

Local Services to Regd. Taxpayers

Shows sales entries where

- Tax Slab must be made as GST System and category = Services

- SGST and CGST Rates are specified

- Customer’s State code and GST No. is given properly

- Sale Type Region = Local

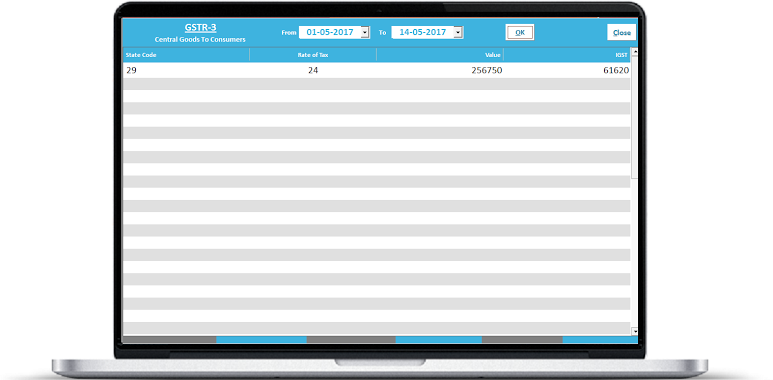

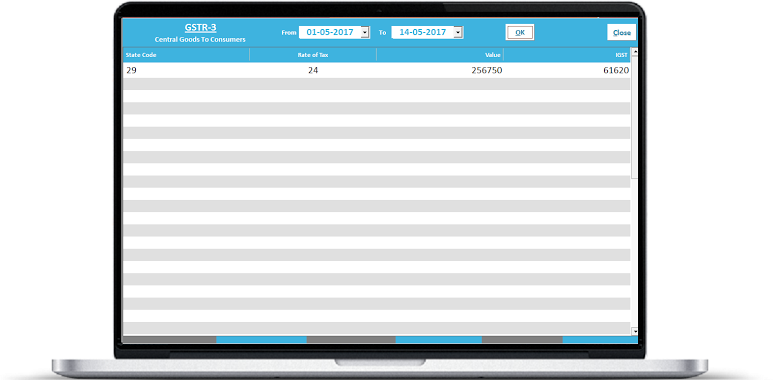

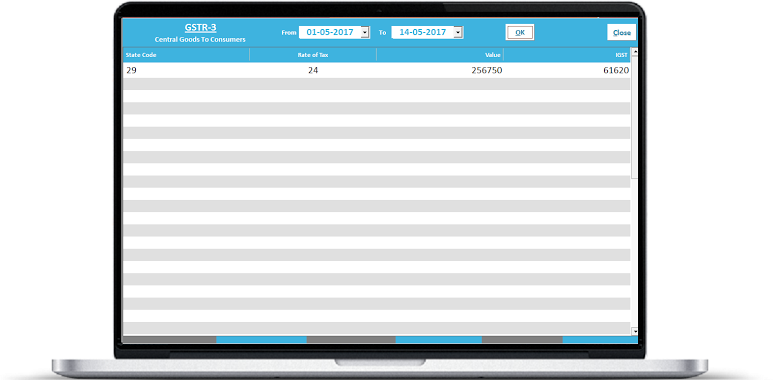

Central Goods to Consumers

Shows sales entries where

- Tax Slab must be made as GST System and category = Goods

- IGST Rates are specified

- Customer’s State code and GST No. is given properly

- Sale Type Region = Central

Local Goods to Consumers

Shows sales entries where

- Tax Slab must be made as GST System and category = Goods

- CGST and SGST Rates are specified

- Customer’s GST No. is blank

- Sale Type Region = Local

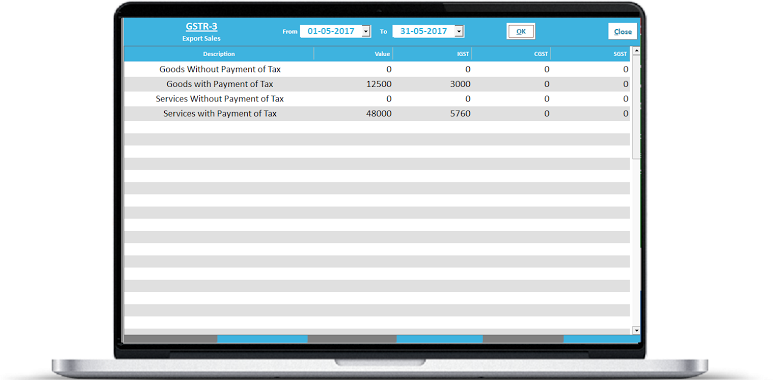

Export Sales

Shows sales entries where

- Tax Slab must be made as GST System and category = Goods OR Services

- IGST, SGST, CGST Rates are specified

- Sale Type Region = Central + Exports

Total Tax Liability on Sales

Shows sales entries where

- Tax Slab must be made as GST System and category = Goods OR Services

- IGST, SGST, CGST Rates are specified

- Sale Type Region = Central + Exports

Pricing Table

Startup

3 Month Subscription

Account Management

Items Management

Sales Management

Purchase Management

Payment Management

Outstanding Analysis

GST Reports & GST Return E-Filing

Email : info@p3webs.com

Business

Life time Subscription

Account Management

Items Management

Sales Management

Purchase Management

Payment Management

Outstanding Analysis

GST Reports & GST Return E-Filing

Email : info@p3webs.com